January 2026 – The Asia-Pacific seafood industry is facing a challenging start to the year. Multiple batches of seafood have triggered international trade alerts due to excessive heavy metal residues, specifically Lead (Pb) and Cadmium (Cd). For exporters, these violations result in more than just brand damage; they lead to costly customs delays, high storage fees, and the risk of mandatory product destruction.

Understanding the Bioaccumulation Risk

Heavy metals pose a significant threat due to their "stealth" nature and bioaccumulative properties. In shellfish and crustaceans, metals accumulate unevenly within muscle tissues and internal organs. This accumulation is often randomized by seasonal currents and sediment changes. To counter this, industry leaders are shifting from finished-product testing to front-end screening of live aquatic tissues.

Global Compliance: A Moving Target

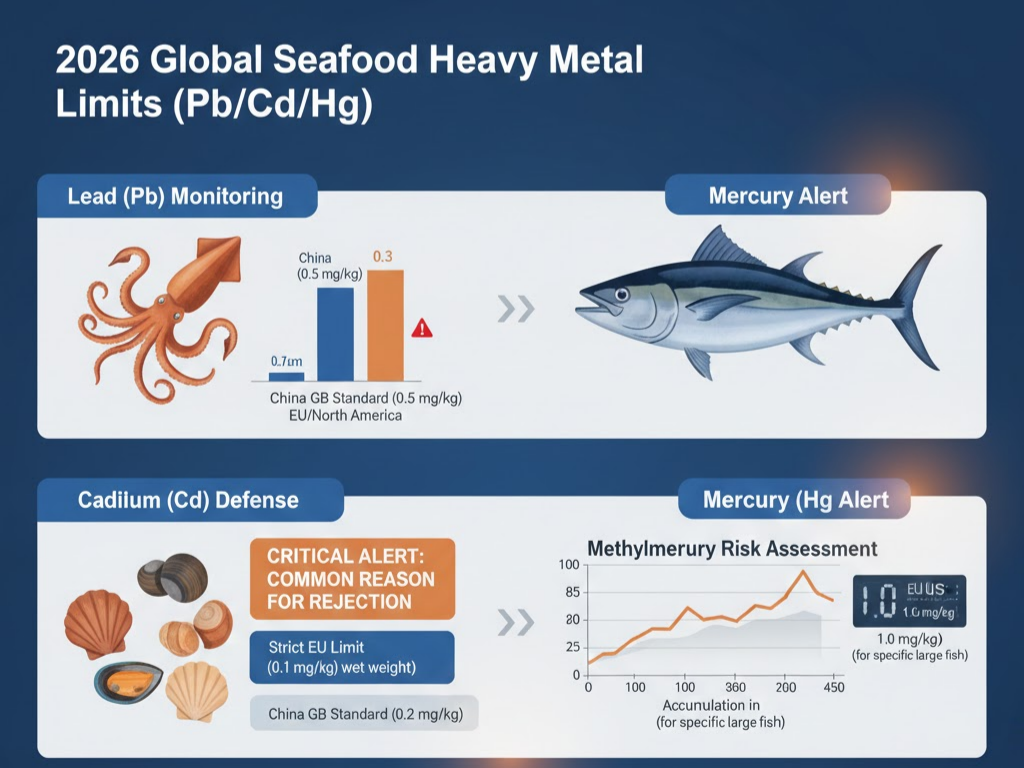

Navigating the 2026 regulatory landscape requires precise benchmarking. Data from the FSTest Global Monitoring Center highlights critical disparities in international standards:

l Lead (Pb): Monitoring is focused on cephalopods like squid. While China’s GB standard permits 0.5 mg/kg, stricter markets require levels as low as 0.3 mg/kg.

l Cadmium (Cd): A primary cause for rejection in shellfish. The EU maintains a strict wet weight limit of 0.1 mg/kg, compared to 0.2 mg/kg in other regions.

l Mercury (Hg): Deep-sea predatory fish require rigorous Methylmercury risk assessments. For specific large fish, the EU and US enforce a 1.0 mg/kg limit.

From Reactive to Proactive Defense

To stay competitive, enterprises are adopting high-interference-resistant detection solutions capable of stabilizing data output in complex protein matrices. By building regional risk models and analyzing historical data, exporters can predict high-risk raw materials before they reach the factory floor.

In 2026, heavy metal control is no longer just a laboratory metric—it is a strategic tool for cost reduction and operational efficiency. By intercepting risks at the source, exporters can ensure seamless global market access.